Right now, a trend in car circles is an influx of buyers acquiring classic cars as an investment. The appreciation numbers are enticing, with some cars seeing values increase over 600% over a few short months.

But this growth is not sustainable.

CNBC interviewed us recently about the value growth of classic cars (as did Investopedia). PAG is one of the only voices in the industry saying it’s unsustainable. Yet, our opinion remains resolute: these rising values are a bubble. And enthusiasts, collectors, and investors alike will suffer the consequences of buying high and selling low once the bubble bursts.

Buy What You Love

Some cars will continue to go up in value. However, our recommendation for these acquisitions has never wavered. Buy what you love, after putting in adequate time for research. By adopting this principle, you have the tough choice of how to react if values increase. If values tank? So what. You own a car that you can enjoy for many years while you wait for values to reset.

Why the Buzz?

The classic economic rule of supply and demand applies. As should a case study in risk.

More Demand

Traditionally, only enthusiasts and collectors have been interested in buying classic cars. Especially older vehicles that require TLC and an understanding of how they work in order to enjoy them. Recently, an influx of “outside money” is vying for the same limited number of cars.

High-net-worth individuals are looking for alternate investments, right now. Family offices and even hedge funds have turned to classic cars.

They could invest in real estate or a Picasso. But you can’t drive a million-dollar painting. It’s an alternative investment strategy that they can enjoy—not just the returns, but the ownership. What’s more fun: monitoring a computer screen of investments funds or curating a collection of classic cars?

Limited Supply

The cars being purchased for investment were manufactured in minimal numbers and have long been out of production.

It used to be that only car guys were buying these rare vehicles. But now more people are looking for a trophy to put in their garage (and the rising values that come with it).

They only made a handful of some specialty models—there’s only 300 Ferrari Enzos. With all the extra interest and cash going after a limited supply, values are skyrocketing.

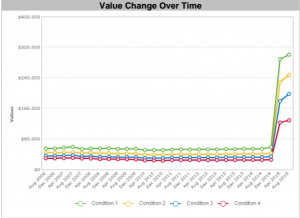

Case Study: 1994 Porsche 911 Turbo

The value of a 1994 Porsche 911 Turbo has spiked from $55,000 to $300,000 in the past nine months. In the ten years previous, the evaluation has largely remained unchanged.

The value of a 1994 Porsche 911 Turbo has spiked from $55,000 to $300,000 in the past nine months. In the ten years previous, the evaluation has largely remained unchanged.

If this trend were to continue, the value of this car would top a million dollars by 2016. To count on a regular 600% growth in value would not be wise. The evaluation will return to earth someday.

This new trend is based on speculation. At some point, the house of cards will come tumbling down. Who’s going to be holding the bag when the music stops? The investor.